How to Make an Invoice – Step by Step Guide

5min read

|

Feb 12, 2026

Create a professional invoice in minutes using templates, online tools, or

invoicing software — no accounting knowledge required.

Creating a professional invoice doesn’t have to be complicated or time-

consuming. With the right layout and tools, you can generate a clear, compliant

invoice in just a few minutes — even if you have no accounting

background.Whether you invoice occasionally or manage recurring clients, the

following steps will help you create invoices that look professional and get paid

faster.

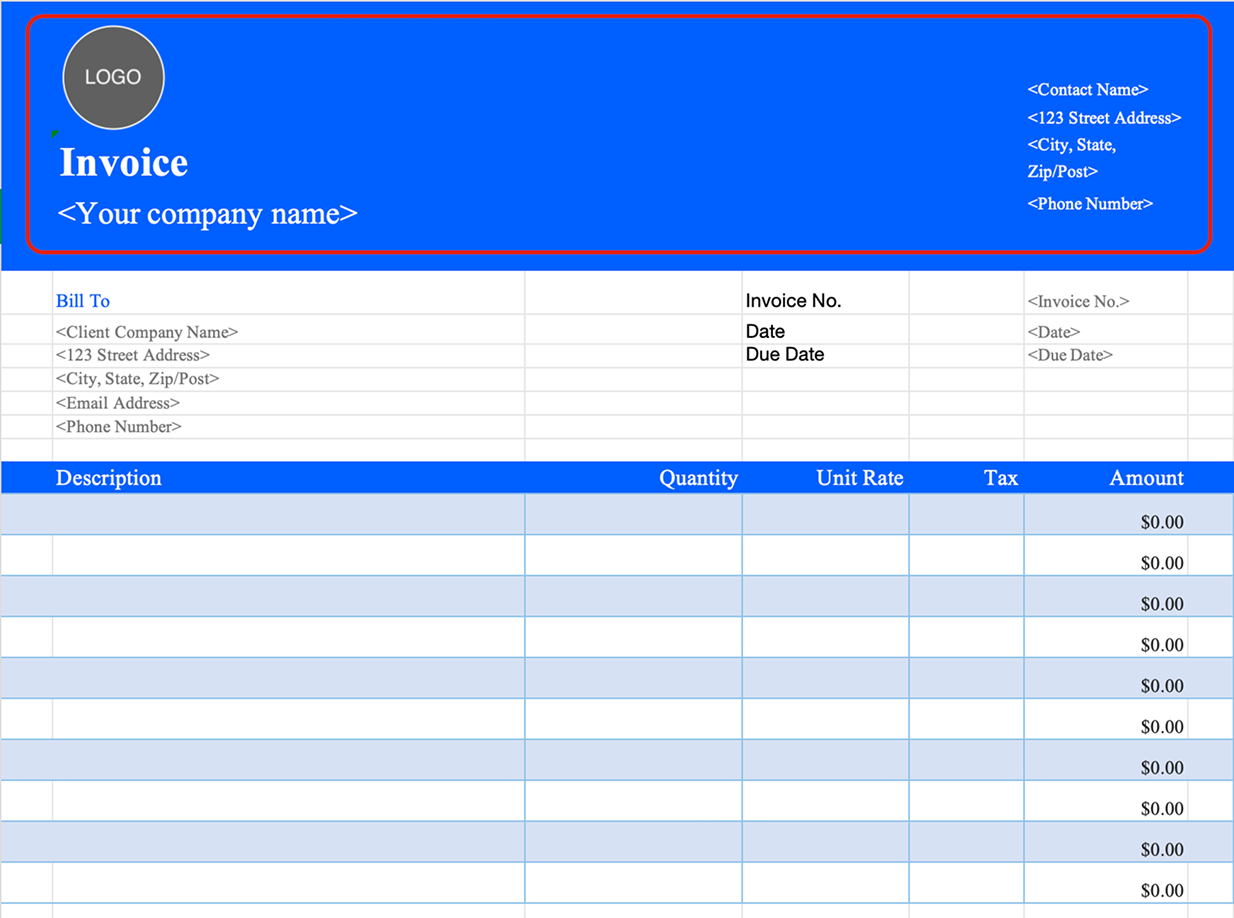

Step 1: Choose a Professional Invoice Layout

Before adding any details, start by choosing a clean, professional invoice

layout.

A well-structured layout makes your invoice easier to read, easier to pay, and

more likely to be accepted by clients. A clear layout also reduces back-and-

forth questions and helps your invoice look consistent with your brand. You can

choose one of the following methods to create your invoice layout.

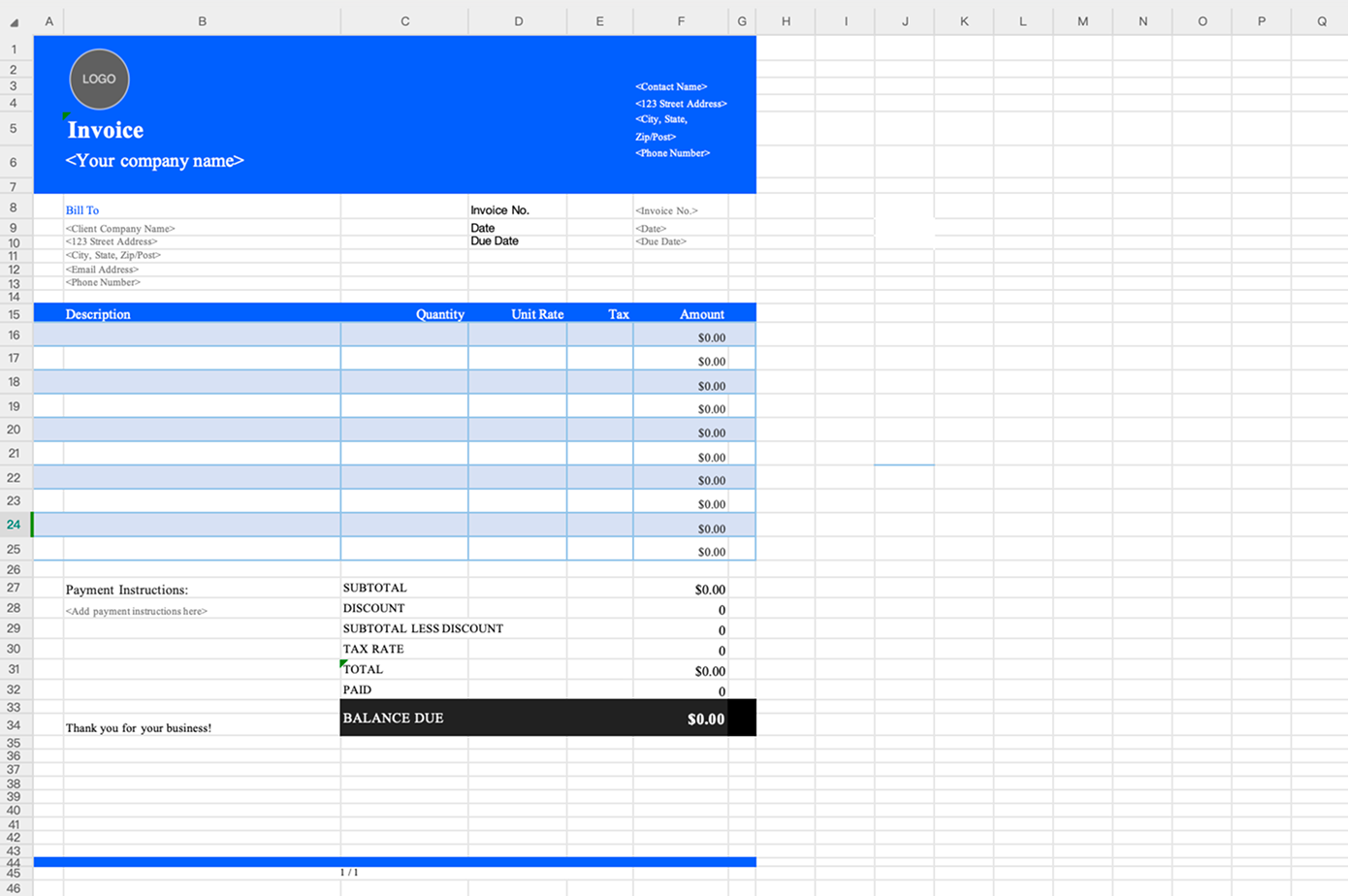

Option 1: Create Your Own Invoice Layout (Excel or Spreadsheet)

You can build a custom invoice using Excel or Google Sheets.

Best for:

Occasional invoicing, full layout control, and users comfortable with formulas.

Your spreadsheet layout should include:

- Invoice title and header

- Business information

- Client details

- Itemized services or products table

- Subtotal, tax, and total amount

While spreadsheets give you flexibility, manual layouts require careful

formatting and calculations. Errors in formulas or inconsistent formatting can

easily lead to incorrect totals or an unprofessional appearance, especially as

invoice volume increases.

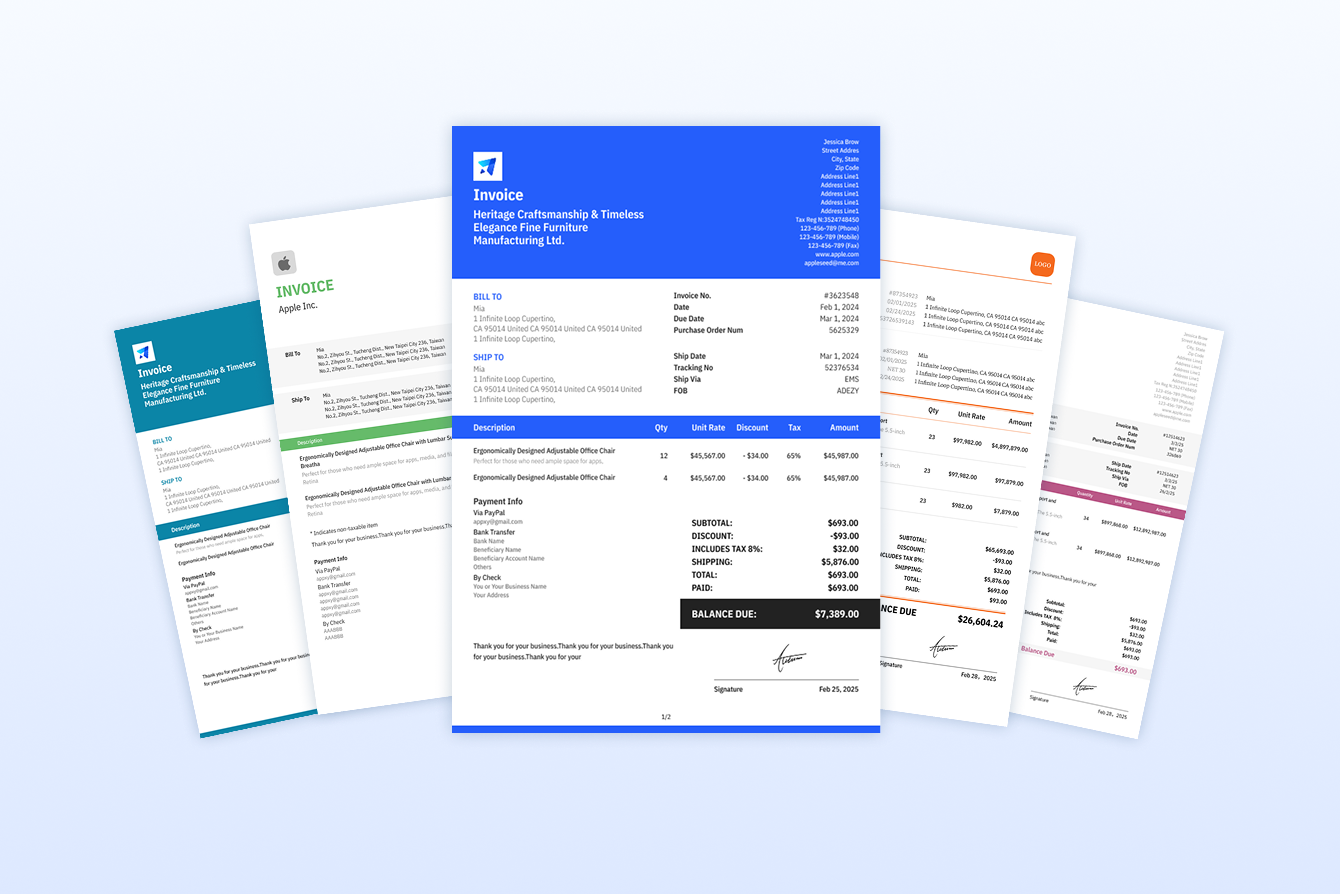

Invoice templates help you skip design work and start invoicing

immediately.

Available formats:

- Excel

- Word

Templates provide a consistent structure and reduce setup time. Choose a

template that fits your industry, currency, and billing style to ensure your invoice

looks familiar and professional to clients.

Best for:

- Freelancers and small businesses

- Standard invoicing needs

- Fast setup with minimal effort

While templates save design time, they still require manual input, similar to

creating an invoice in a spreadsheet. Filling in data can be time-consuming,

and because templates are editable, it’s easy to accidentally change the layout

or break the formatting.

An online invoice generator automatically creates a professional layout for you.

This is one of the most convenient options. It offers several clear advantages

including

- Freelancers and small businesses

- Standard invoicing needs

- Fast setup with minimal effort

This option eliminates formatting and math errors, while also saving time. Online

generators are especially useful when you need to create, send, and track invoices

quickly without managing files manually.

One limitation is that most online invoice generators do not save client or

product information. This means you may need to enter the same details again

each time you create a new invoice.

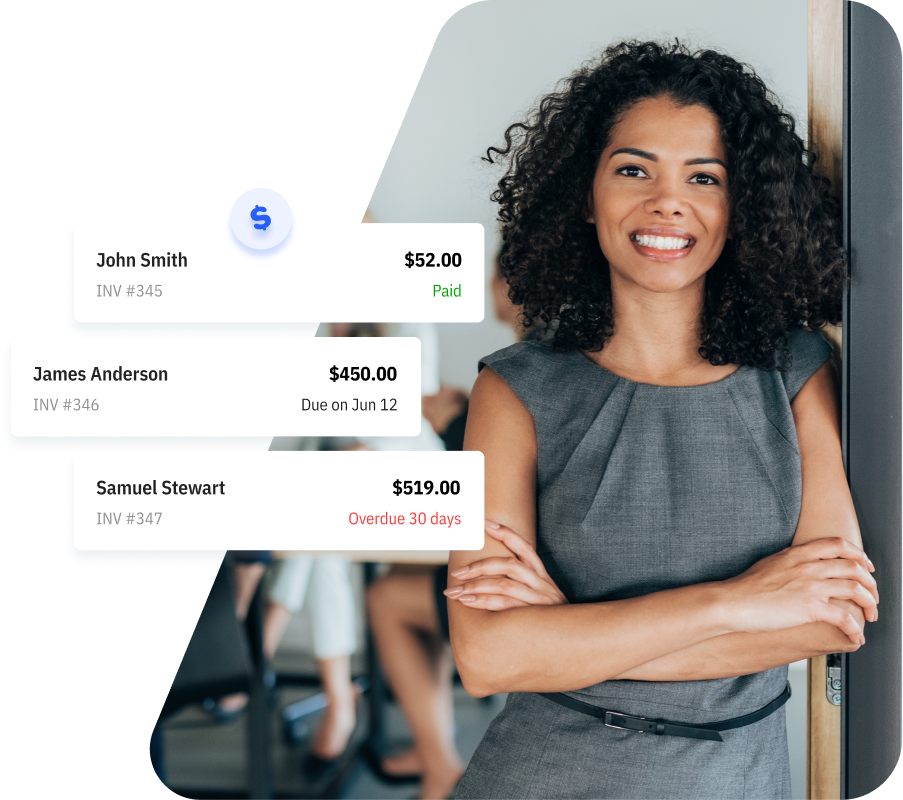

Option 4: Use Invoicing Software

If you send invoices regularly, invoicing software offers more control and

automation. Features often include client management, invoice history,

recurring billing, and payment tracking.

Ideal for:

- Contractors and agencies

- Recurring clients

- Growing businesses

Invoicing software helps you stay organized as your business scales, reducing

administrative work and improving cash flow visibility.

Although these options differ in ease of use and convenience, the information

required on an invoice is the same in all cases. The right choice depends on

your needs and how often you invoice. Below, we’ll use a basic invoice

template as an example to show how to fill out an invoice step by step.

Step 2: Add Your Business Information

Once the layout is ready, add your business details at the top of the invoice.

Required information:

- Business name

- Address

- Email or phone number

- Logo (optional but recommended)

Clear business information helps clients verify who the invoice is from and

builds trust.

💡 Tip: Save your business profile so you don’t need to re-enter it every time.

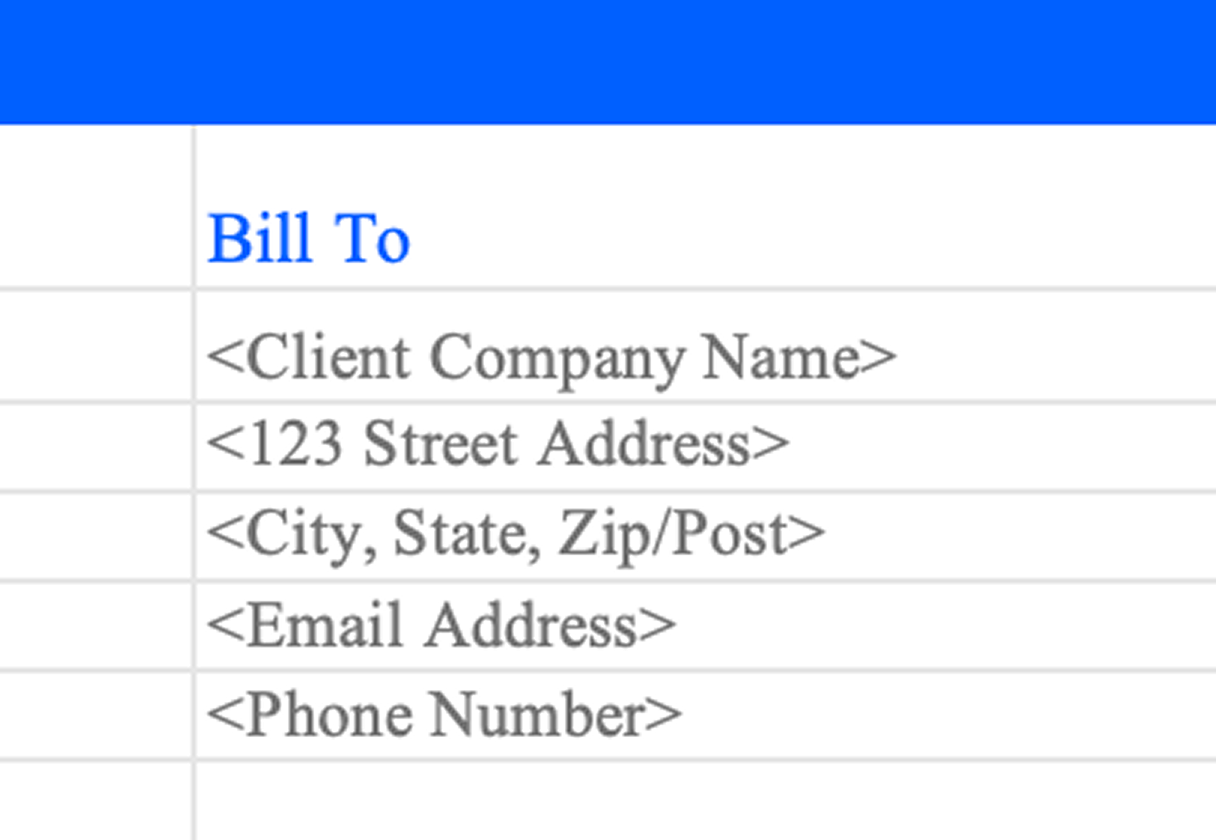

Step 3: Add Client Information

Correct client details help avoid payment delays and disputes. Look for the “Bill

To” section and enter the following details in the invoice template.

- Client or company name

- Billing address

- Invoice email address

Using accurate, complete client information ensures the invoice

reaches the right person and can be processed without issues.

❌ Avoid using nicknames or incomplete company names.

Step 4: Assign an Invoice Number and Dates

Every invoice should have clear identifiers for tracking and record-keeping.

Add the following:

- Invoice number (must be unique)

- Invoice issue date

- Payment due date

Example numbering formats:

- INV-2025-001

- INV-CLIENT-002

Consistent numbering makes it easier to track payments and resolve disputes.

Most invoice generators can assign numbers automatically.

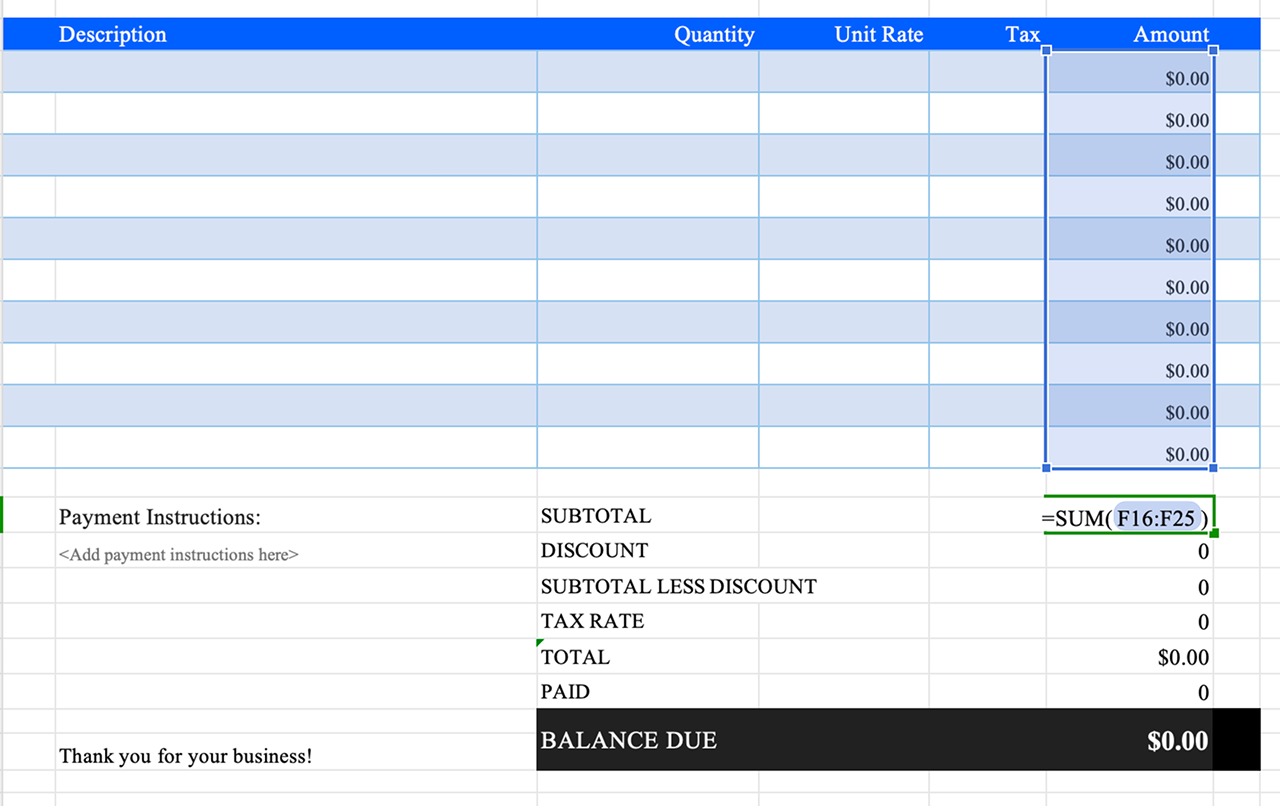

Step 5: List Products or Services

Use an itemized list so clients clearly understand what they're paying for.

Standard fields:

- Description

- Quantity or hours

- Unit price

- Line total

Example:

Website design service - 10 hours x $50 = $500

Itemized invoices reduce questions, improve transparency, and speed up approvals and payments.

Step 6: Calculate Subtotal, Tax, and Discounts

Follow this calculation order:

- Subtotal

- Tax (VAT, GST, or sales tax if applicable)

- Discount (optional)

- Total amount due

Most templates include built-in formulas, so at this step you usually only need

to enter the tax rate and discount. However, calculations still depend on correct

input. Using an invoice generator or invoicing software helps avoid calculation

mistakes and ensures totals are always correct.

Step 7: Add Payment Terms and Methods

Clear payment terms help you get paid faster and set expectations upfront.

This information is usually placed in the bottom-left section of the invoice.

Include:

- Payment terms (Net 7, Net 14, Net 30)

- Accepted payment methods

- Late payment note (optional)

Example:

Payment is due within 14 days of the invoice date.

Clear terms reduce confusion and minimize late payments.

Step 8: Review and Send the Invoice

Before sending, double-check:

- Totals and tax amounts

- Client email address

- Invoice number and due date

Send options:

- Download as PDF

- Email invoice directly

- Share invoice link

PDF format is recommended for professionalism and compatibility across

devices.

Step 9: Save the Invoice as a Reusable Template

If you invoice similar services repeatedly, save your invoice as a template.

Best for:

- Monthly clients

- Fixed pricing services

- Recurring work

Templates save time, reduce errors, and help maintain a consistent brand

image. If you need more speed and flexibility,

our invoicing software

lets you

save client and product information for future use. This allows you to create

and send invoices in just a few clicks. You’ll also have access to advanced

features like invoice management and payment tracking.

Most Popular Pages

Try Tiny Invoice Today

Start Sending Invoices, Building Reports, Saving Office

Time and Get Paid Faster.